Financial Services Digital Marketing

Overview of Financial Services Digital Marketing

The financial services industry comprises a range of sectors, including banking, insurance, investments, and fintech. In an era characterized by rapid digital transformation, organizations must leverage marketing strategies that connect with consumers effectively. According to the FIS Global Payments Report, global e-commerce accounts for over 23% of total retail sales, underscoring the importance of a digital-first approach in engaging consumers.

Importance of a Marketing Plan

Without a clear marketing strategy, financial firms may struggle to stand out in a crowded marketplace. According to the Content Marketing Institute, 70% of marketers reported creating more content than they did the previous year, yet only 37% felt their efforts were effective. A well-defined strategy helps organizations utilize resources effectively, improve engagement, and ultimately boost ROI.

Furthermore, a study by HubSpot noted that inbound marketing, which focuses on creating valuable content to attract customers, can generate 54% more leads than traditional outbound marketing strategies.

Understanding Customer Behavior for Financial Services Digital Marketing

Modern consumers conduct extensive research before making financial decisions. The 2019 Edelman Financial Services Study reported that 60% of consumers prefer to conduct their research online rather than speaking directly with a financial advisor. Additionally:

- McKinsey & Company found that consumer preferences have shifted, with 75% of respondents indicating they prefer digital interactions over in-person meetings for financial services.

- An Experian report showed that 75% of consumers want personalized communications from financial services firms, which indicates a need for tailored content that addresses individual customer needs and preferences.

Creating Quality Content

Engaging, informative content is essential for attracting and retaining clients in the financial industry. Notable statistics include:

- Infographics: According to HubSpot, infographics are liked and shared on social media three times more than other types of content. Financial institutions can employ infographics to simplify complex financial concepts and data, making them more digestible for consumers.

- Video Marketing: The Insivia report states that 84% of consumers say they’ve been convinced to buy a product or service by watching a brand’s video. In financial services, video can be used to explain services like mortgages or investment strategies in an engaging format.

- Blogging: According to HubSpot, companies that blog receive 97% more links to their website, enhancing search engine optimization (SEO). A well-maintained blog can position your firm as a thought leader and improve your ranking on search engines.

An Omnichannel Approach, Financial Services Digital Marketing

Creating a seamless experience across various touchpoints is crucial.

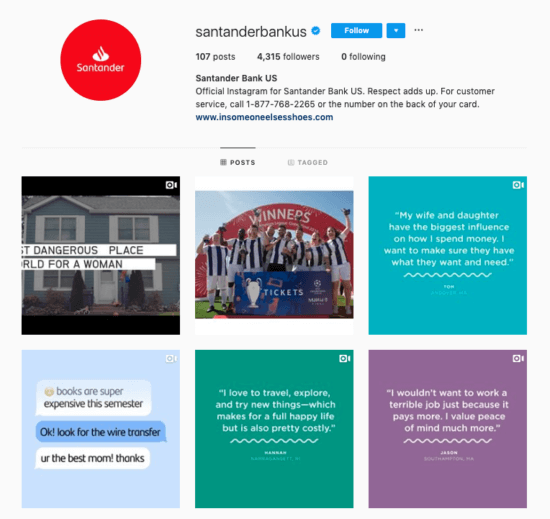

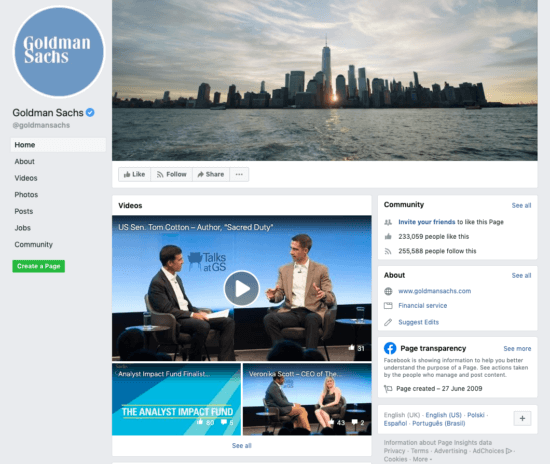

- Social Media Statistics: According to a report from We Are Social, 4.62 billion people around the world are active social media users, making it a vital platform for reaching potential clients. A strong social media presence can enhance brand loyalty, with 57% of consumers who follow brands on social media more likely to buy from them, according to Sprout Social.

- Email Marketing: The Direct Marketing Association reports that email marketing has an average ROI of $42 for every dollar spent. Additionally, personalized email campaigns can yield conversion rates up to 10 times higher than general messaging, showing the power of targeted communication.

Compliance with Regulations

Financial services marketing is subject to a number of regulations designed to shield consumers from deceptive advertising. Key regulatory frameworks include:

- The Truth in Lending Act (TILA) requires clear disclosure of key terms and costs of borrowing, ensuring consumers fully understand the financial products they’re considering.

- The Gramm-Leach-Bliley Act (GLBA) mandates that financial institutions safeguard their customers’ personal information, which extends to how firms collect and use customer data in marketing.

A survey by J.D. Power found that 53% of consumers expressed skepticism about their bank’s data practices. As such, financial institutions must ensure transparency and maintain consumer trust by adhering to these regulations and clearly communicating their data practices.

Conclusion of Financial Services Digital Marketing

In a fiercely competitive landscape, having a robust digital marketing strategy tailored for financial services is essential. By adopting an omnichannel approach and focusing on high-quality, compliant content that addresses consumer needs, financial firms can enhance their brand visibility and trustworthiness.

Key Statistics Recap:

- 80% of consumers prefer online research before engaging with financial advisors.

- Companies that blog receive 97% more links to their website.

- 54% more leads can be generated through inbound marketing compared to traditional methods.

- Email marketing returns an average of $42 for every dollar spent.

- 75% of consumers appreciate personalized communication.

Action Plan: Start crafting your marketing plan today by focusing on creating valuable, informative content and employing data-driven strategies that resonate with your audience. Adhering to compliance regulations will further bolster your reputation, leading to long-term growth and customer loyalty.